Case studies

Publication Date

20 September 2021

Published

20 Sep 2021

Purchase of air rights for mixed use development

Context

The Hudson Yards project is the largest mixed-use private real estate development in the United States by area (28 acres) and is projected to cost USD25 billion upon completion. West Side Yard is a rail yard owned by the Metropolitan Transport Authority, to store and maintain trains running primarily to Penn Station and upstate New York, the West Side Yard was designed with space between the tracks for columns to support the development of air rights.

Problem

- The cost of real estate is prohibitively expensive on Manhattan, and there is limited ground space for further development.

- Public structures in New York, including landmarks and mass transit facilities, are often lower-density than commercial and residential facilities. There is undeveloped space above these structures.

Innovation

- Transferable development rights (TDRs) or air rights, allow for the transfer of unused development rights to another development site. The transfer of these air rights allows buildings to become taller and bigger than the city zoning code allows.

- Related Companies leased the air rights above Hudson Yards for 99 years from the Metropolitan Transport Authority, at a cost of USD1 billion.

- The Hudson Yards development will be constructed on top of a deck supported by 300 concrete and steel caissons, which are laid in between railway tracks.

Stakeholders involved

- Related Companies: Primary developer and major equity partner, with a 60% stake in the program

- Oxford Properties: The other primary developer and major equity partner

- Metropolitan Transport Authority: Owner of the air rights above Hudson Yards

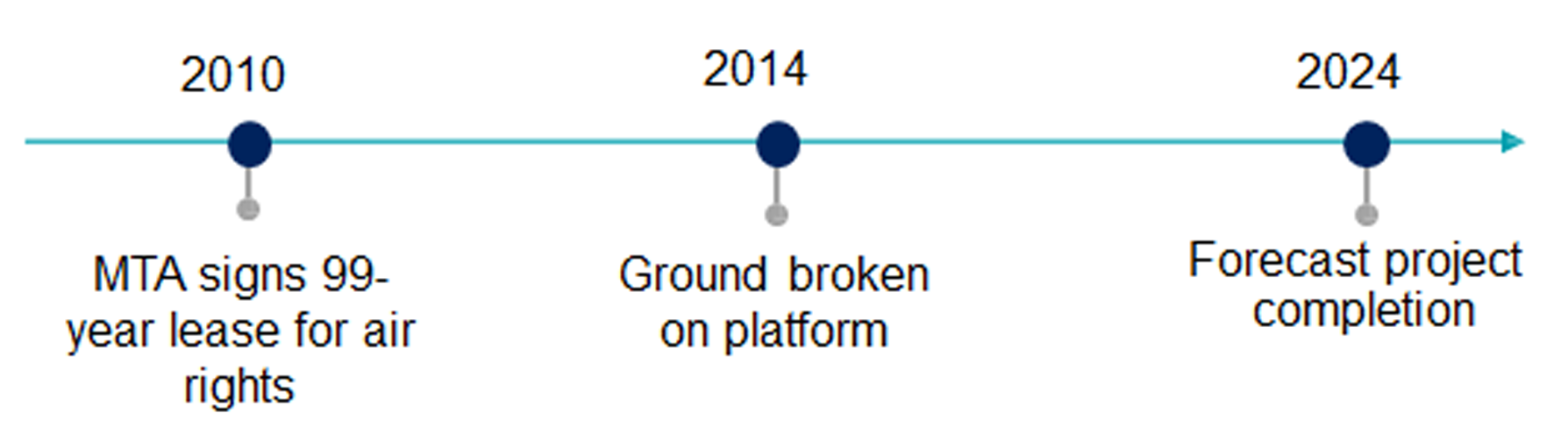

Timeline

Results and impact

Results and impact

- Construction of 16 new buildings with 4,000 apartments (430 are affordable housing), a school, parkland, and 55,000 jobs for firms such as BCG, Wells Fargo, SAP, and BlackRock

- Long Island Rail Road trains can continue to operate during Hudson Yards construction, ensuring minimal disruption to mass transit. There were only four track closures in the first 2.5 years of construction.

- Metropolitan Transport Authority raised USD1 billion for future capital projects.

Key lessons learnt

- Sale of air rights can be used to unlock value and development potential in urban areas, particularly where there is limited ground space for development and smaller, public, or heritage-listed buildings have the capacity to sell their developmental rights.

- Proceeds from the sale of air rights is one form of ancillary revenue generation for asset owners. In this case, MTA can utilise this money to fund its operations and future developments on its network.