47 results found

Latin American and the Caribbean (LAC) countries have a large, and increasing, infrastructure quantitative, qualitative and efficiency gap. The lack of sufficient physical assets, inadequate maintenance and poor service provision negatively impacts the quality of life of its population and the competitiveness of its economies. Over the last three decades public investment remains low at less than 2% of GDP, half of what East Asia invests in infrastructure per year. During the COVID-19 economic crisis, although the need for increasing public investment has grown this hasn’t translated into reality. Historically public investment will not increase because the region is characterized by a bias against infrastructure assets in favor of current expenditures during economic crises. Additionally, investment in infrastructure in LAC is perceived as a risky proposition in times of fiscal imbalances and debt growth. The average fiscal package to mitigate the impacts of COVID-19 was 8.5% of GDP and deficits increased by an average of 5.3% of GDP in 2020, propelling the public debt from 58% of GDP in 2019 to 72% in 2020 and it could continue to rise to 76% in 2023. Preliminary estimates confirm that governments in LAC invested less than 1.5% of GDP in infrastructure in 2020, not a promising scenario for a major shift in public investment to close the regional infrastructure gap.

On average, around 40% of the primary infrastructure transactions that involve private sector participation also involve a public institution. However, this varies by income group.

Policy and regulatory implications of recent advances in the benchmarking of infrastructure investments.

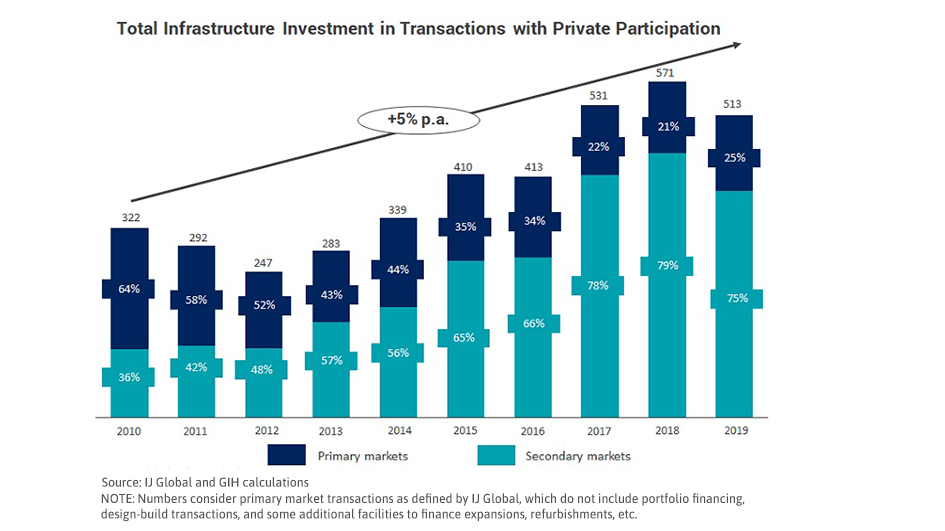

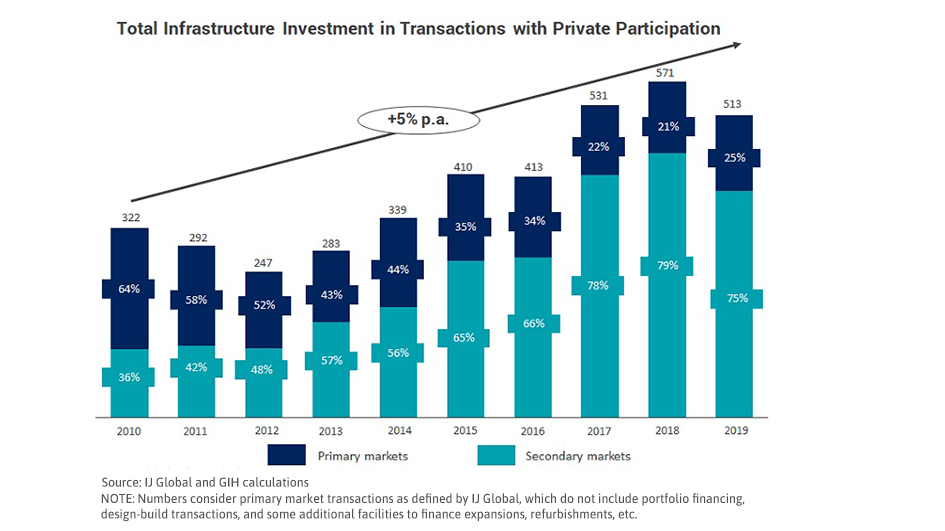

As stimulus spending ramps up, a ten-year trend study shows private investment in new infrastructure has declined since 2010.

Bridging the US$15 trillion infrastructure gap has become crucial given the economic impact of COVID-19. GI Hub's Strategic Advisers deep-dive into a way forward to attract private capital.

Public investment in infrastructure is more effective in increasing economic output than other types of public spending

Investment in public transit infrastructure can contribute to creating more inclusive societies. Public transit services are more often used by lower-income households, women and ethnic minorities.

Public investment in infrastructure is more effective in increasing economic output than other types of public spending

Investment in public transit infrastructure can contribute to creating more inclusive societies. Public transit services are more often used by lower-income households, women and ethnic minorities.

The COVID-19 health crisis has highlighted the chronic underinvestment in social infrastructure around the world. Dr. Georg Inderst discusses Global Infrastructure Hub’s recently released Infrastructure Monitor 2020 report and what can be done to attract more public and private investors to social infrastructure.

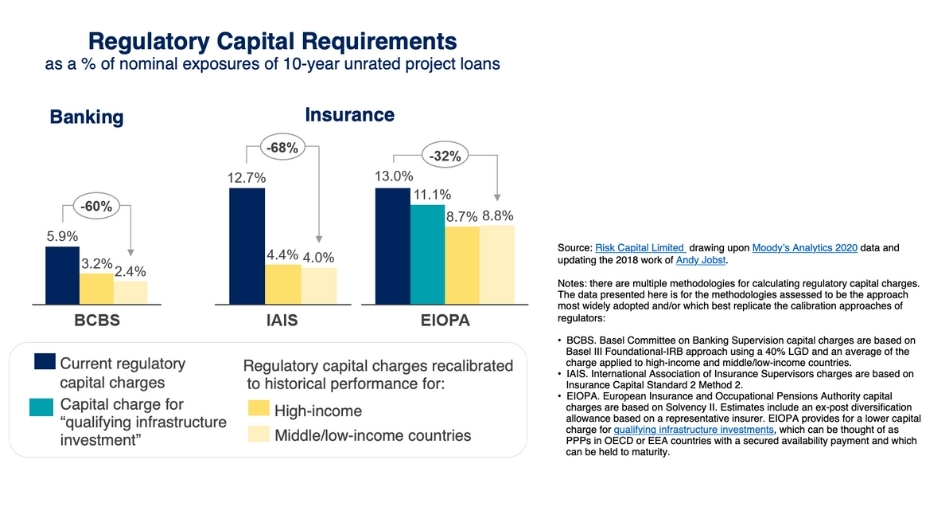

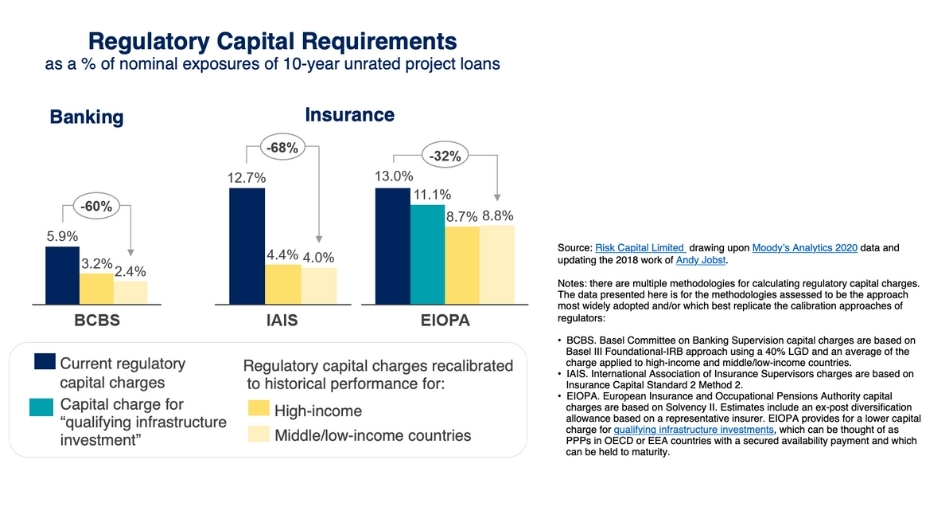

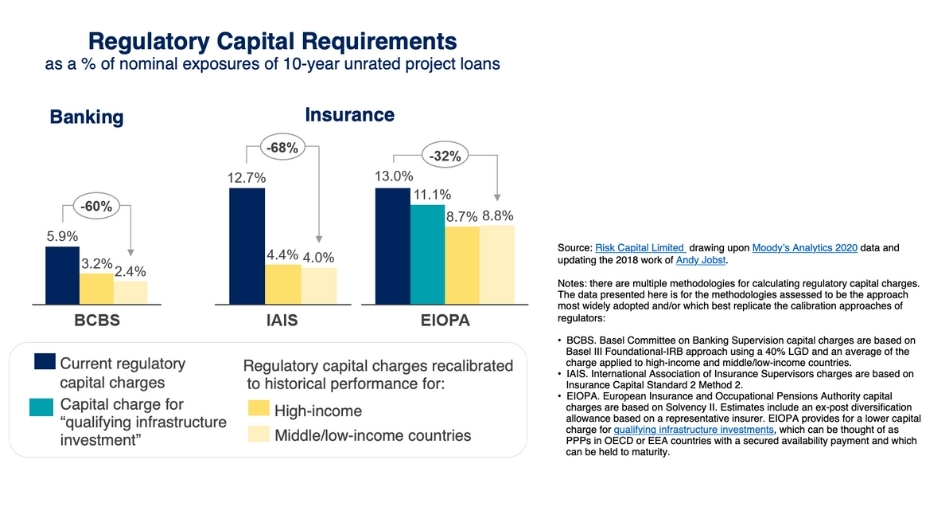

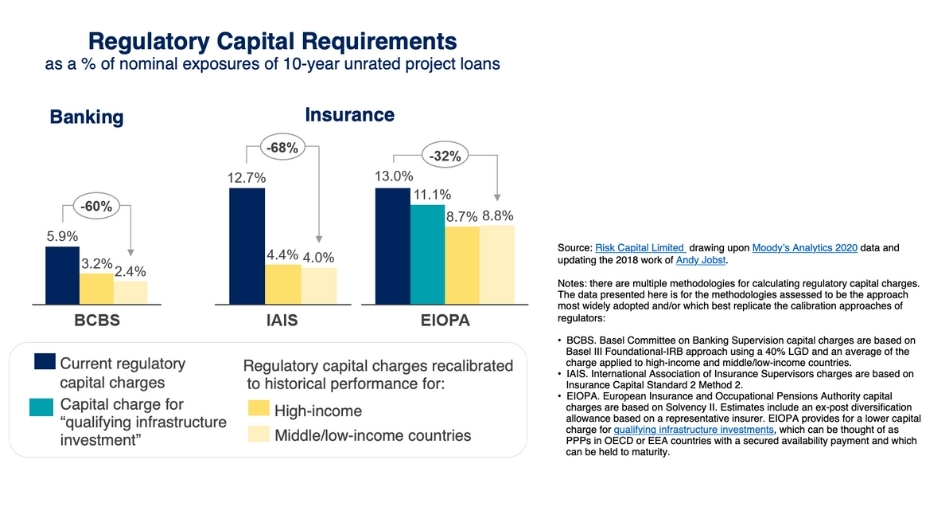

Regulatory capital frameworks require banks and insurers to put aside more capital for infrastructure investments than is warranted by their historical credit performance

Regulatory capital frameworks require banks and insurers to put aside more capital for infrastructure investments than is warranted by their historical credit performance

New insights from the GI Hub’s Infrastructure Monitor and InfraCompass show that a strong enabling environment matters for encouraging more private infrastructure investment, regardless of income level.

An introduction to our new blog series on policy implications related to key data findings from Infrastructure Monitor.

Private investment in infrastructure through primary market transactions remains low at around US$100 billion per year and has been declining over the past decade according to a new Global Infrastructure Hub (GI Hub) report, Infrastructure Monitor 2020.

While total infrastructure investment with private participation has increased over the past decade, this has been driven by secondary market transactions. Primary market transactions are low and have been declining.

Private investment in social infrastructure has seen a sharp decline over the past decade, driven by the healthcare and social housing sub-sectors. In the transport sector, around half of private investment over the past decade has been in the roads, tunnels and bridges sub-sector.

Europe has seen the largest number of infrastructure transactions with private participation over the past decade, although the average value of these transactions tends to be relatively small compared with other regions.

Infrastructure Monitor 2020

Infrastructure Monitor 2020