782 results found

Featured results

More results

Predictive maintenance utilises monitoring and advanced machine learning methods to develop predictive models about failure of physical and mechanical assets such as pipes, pumps, and motors

The Smart Ivrea Project (SIP) envisages the design and implementation of a sustainable, inclusive and technologically advanced city where public services, energy and economic efficiency and social inclusion are the center

Augmented Reality (AR) and Virtual Reality (VR) are both part of a wider field of technology called Mixed Reality (MR).

Developing infrastructure that is sustainable, resilient and inclusive is a complex endeavour and it is even more so in emerging markets.

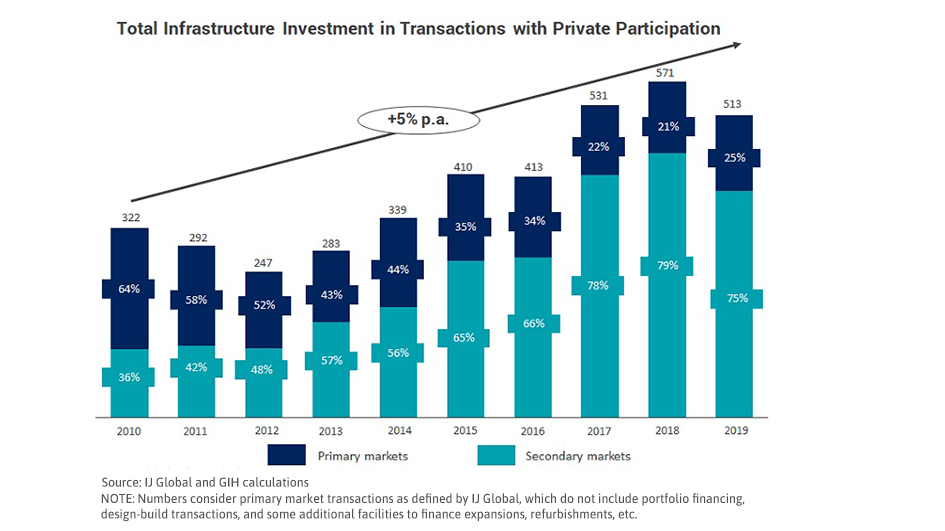

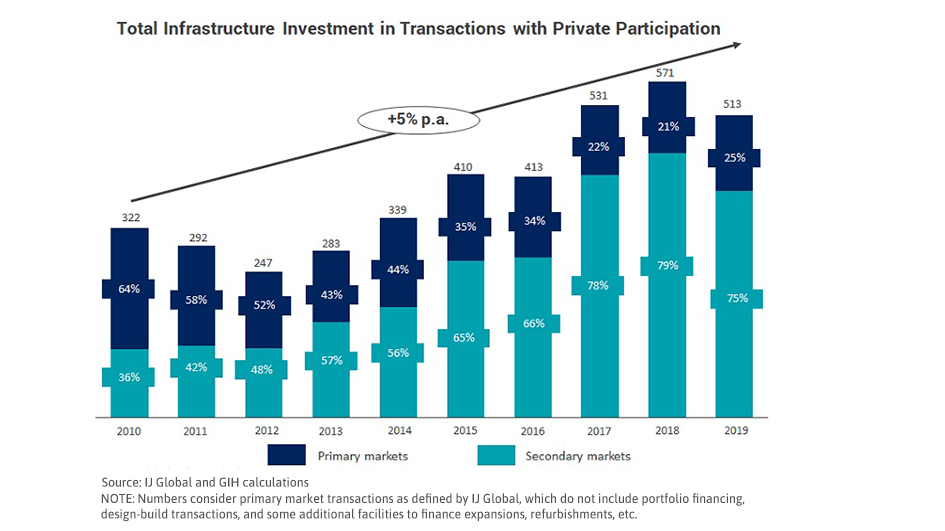

Private investment in infrastructure through primary market transactions remains low at around US$100 billion per year and has been declining over the past decade according to a new Global Infrastructure Hub (GI Hub) report, Infrastructure Monitor 2020.

COVID-19 is the worst crisis since the Great Depression, and it will take significant innovation on the policy front to recover from this calamity.

Infrastructure development should demonstrate social outcomes, argues Marie Lam-Frendo, CEO of the Global Infrastructure Hub.

World Bank Benchmarking Infrastructure Development 2020

Training program to upskill African infrastructure public servants commences

While total infrastructure investment with private participation has increased over the past decade, this has been driven by secondary market transactions. Primary market transactions are low and have been declining.

Europe has seen the largest number of infrastructure transactions with private participation over the past decade, although the average value of these transactions tends to be relatively small compared with other regions.

The value of private investment in PPP infrastructure has gradually declined over the past decade.

Globally, foreign equity in private infrastructure deals amounted to around 12% of total private infrastructure investment over the past decade, with Sub-Saharan Africa having a particularly high reliance on foreign equity.

Sustainable low-carbon private investments have intensified in high-income countries. To strengthen global response to combat climate change, such investments must be accelerated in developing countries.

Private infrastructure investment in low-income countries is almost entirely denominated in foreign currencies, implying a structural foreign exchange risk for investors.

Over the past decade, about three-quarters of private infrastructure investment globally was debt financed, and about a quarter was equity financed.

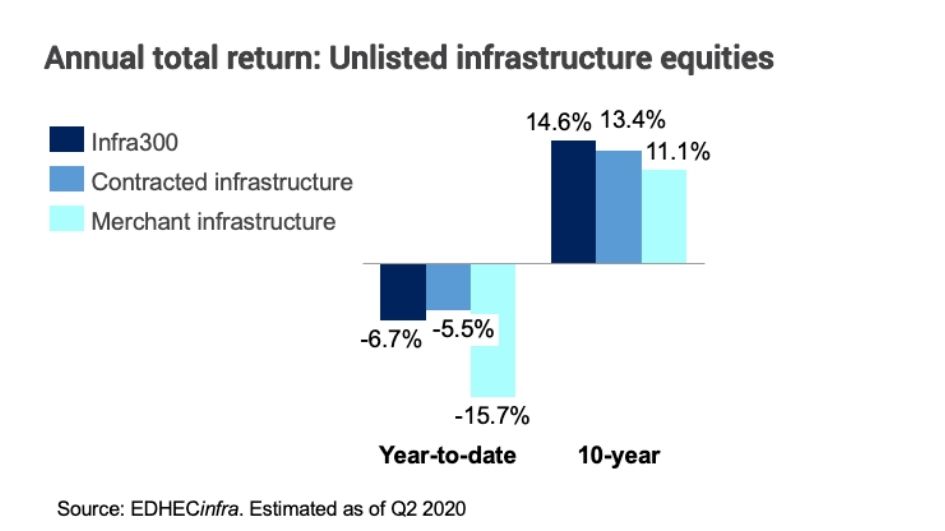

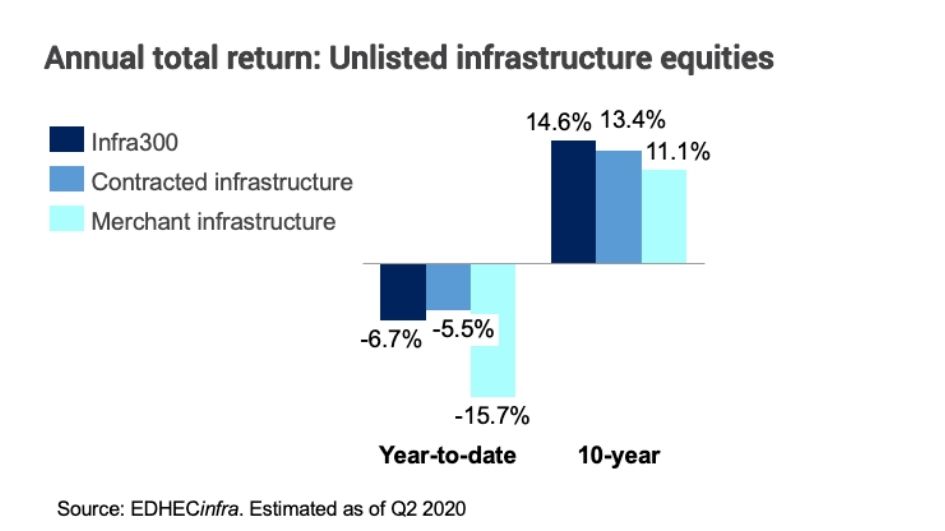

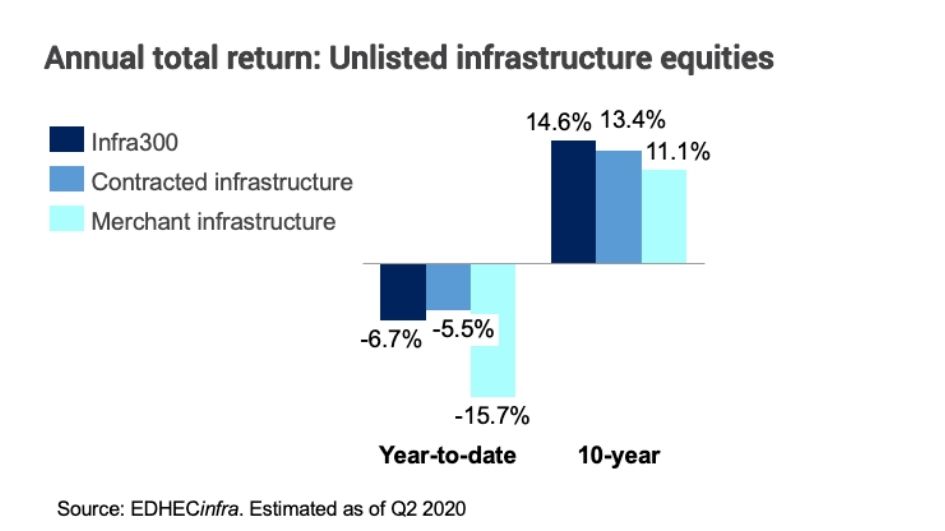

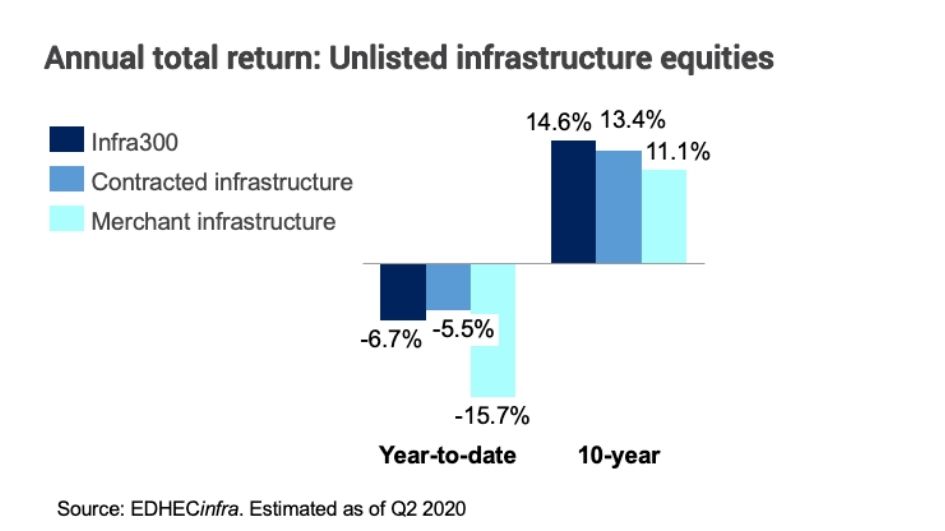

Infrastructure equities have an attractive risk-return profile providing a competitive alternative to other investment options.

Merchant infrastructure, larger investors and the transport sector have experienced larger declines in returns due to COVID-19.

Infrastructure equities have an attractive risk-return profile providing a competitive alternative to other investment options.

Merchant infrastructure, larger investors and the transport sector have experienced larger declines in returns due to COVID-19.

Inclusive Infrastructure and Social Equity Tool

Inclusive Infrastructure and Social Equity Tool