1314 results found

Featured results

More results

What role can the private sector play in a green transition? How is green financing implemented, and what are the current green financing trends? These are a few of the key questions that will be explored in this GI Hub and IFC webinar.

A bond issuance anchored by IFC allowed Liquid Intelligent Technologies to expand access to broadband internet and digital and cloud services across Africa.

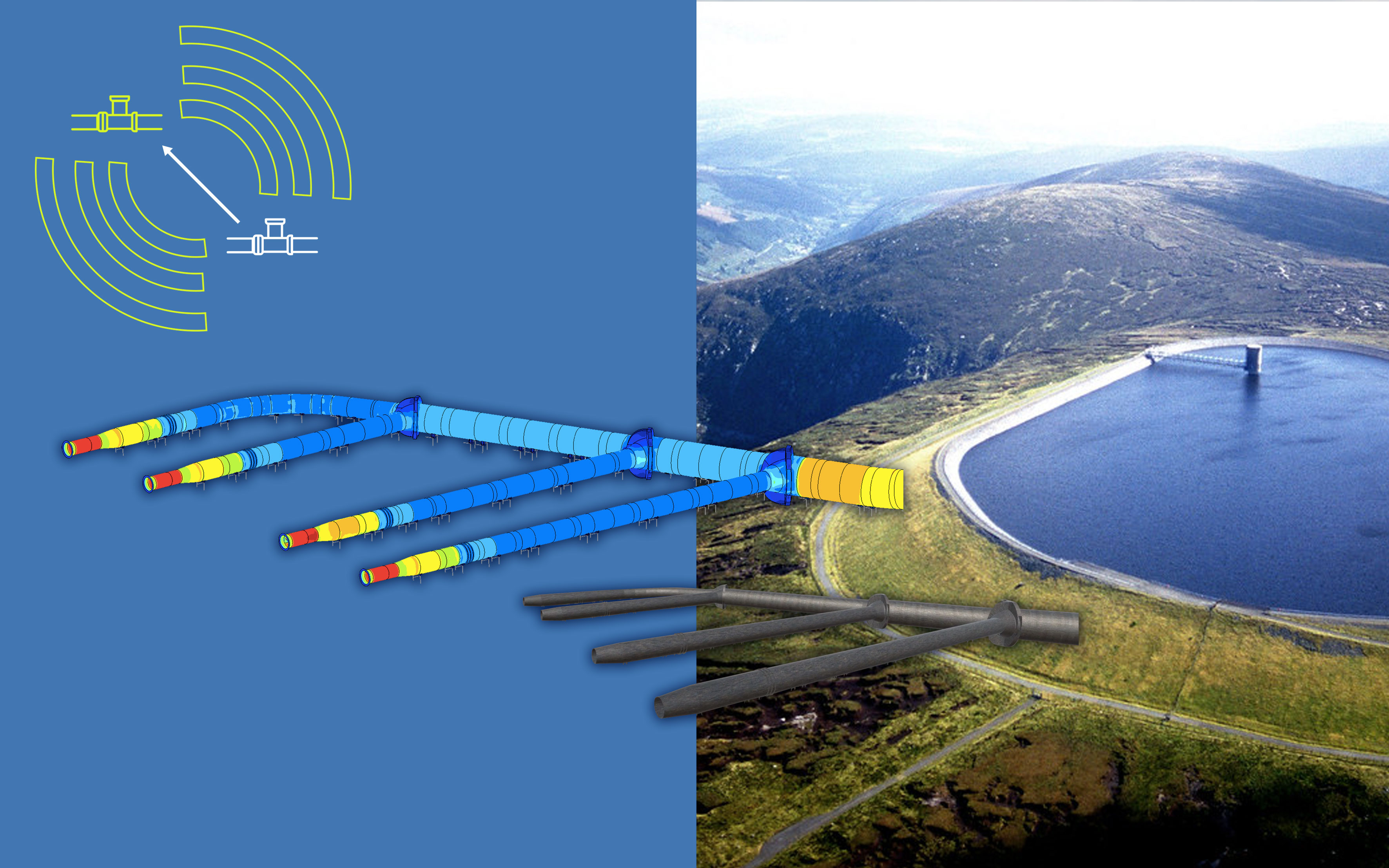

In 2019, Irish electricity company ESB was seeking a solution to help them understand the structural health of its 47-year-old Turlough Hill pumped storage station, which generates up to 292MW into the Irish grid during peak demand periods and – as Ireland’s only pumped storage station – has a crucial role in the country’s ongoing transition to renewable energy grid stabilisation.

A solar leasing project at Singapore's Jurong Port significantly reduced carbon emissions and generated cost savings.

Uganda is targeting a 22% emissions reduction from a business-as-usual scenario by 2030.

Uganda is targeting a 22% emissions reduction from a business-as-usual scenario by 2030. A run-of-river hydropower station project lowered energy costs and reduced greenhouse gas emissions.

Tel Aviv is Israel’s second-most populous city and its main business, technological, and cultural center. Its population has grown at 2% per year; Israeli population growth is ten times the OECD average.

In Senegal, energy is produced by private operators and sold to the Senelec government energy corporation.

Since 2010, Senegal had pursued reform policies within the energy sector, and aimed to increase installed renewable energy to 20% of total installed capacity by 2017.

A significant risk for foreign investors in developing and frontier markets is exchange rate risk, which can greatly alter a project’s rate of return.

This new technology is particularly relevant for boilers, air conditioning, solar power, and lighting infrastructure.

Small- and medium-sized enterprises (SMEs) may benefit greatly from the energy cost savings that result from the installation of new, more efficient technology.

Colombia’s 4G infrastructure program calls for increased public-private partnerships.

It is estimated that Columbia requires USD139 billion invested into its road system to meet infrastructure needs by 2035.

The Mohammed bin Rashid Solar Park is the largest single-site solar park in the world; it uses an Independent Power Producer (IPP model) and a build-own-operate project structure

The UAE Vision 2021 includes the Green Economy for Sustainable Development Initiative. This includes sourcing 75% of Dubai’s power from clean sources by 2050, and 25% from solar power

The Monterrey-Nuevo Laredo highway is an important transit route for trucks and cars in Mexico’s north-east that are looking to enter the United States through Texas

The Hudson Yards project is the largest mixed-use private real estate development in the United States by area (28 acres) and is projected to cost USD25 billion upon completion.

The Federal Government of Nigeria’s Energizing Economies Initiative (EEI) aimed to increase access to energy through private development of off-grid electricity solutions in economic clusters, such as markets, shopping centres, and industrial complexes

The mechanism allows borrowers to obtain financing under syndicated loan (credit) agreements to deliver state-backed infrastructure projects

The Factory is a project finance mechanism for investment projects in Russia’s priority industries, which include manufacturing, heavy engineering, nuclear industries, infrastructure, agriculture, healthcare, and information and communication technology

Many of the bridges are located in rural areas with low traffic volumes, hence PPP solutions are not attractive for investors

In light of Pennsylvania having over 4,500 bridges classified as structurally deficient, the Pennsylvania Department of Transportation (PennDOT) decided to prioritize infrastructure repair and replacement work

Long-term local currency financing is scarce in Kazakhstan. It is only available under state support programs targeting large investment projects for strategic sectors and affordable housing

Hard currency borrowing in Kazakhstan was popular until the Tenge currency collapse in 2014-2015. Borrowers then started looking for local currency financing, but the local market for long-term financing was under-developed

Within the state “Education Development” (2018-2025) program, the Ministry of Education of Russia and the State Development Corporation VEB.RF launched a program of state support for construction and operation of public schools through PPP mechanisms

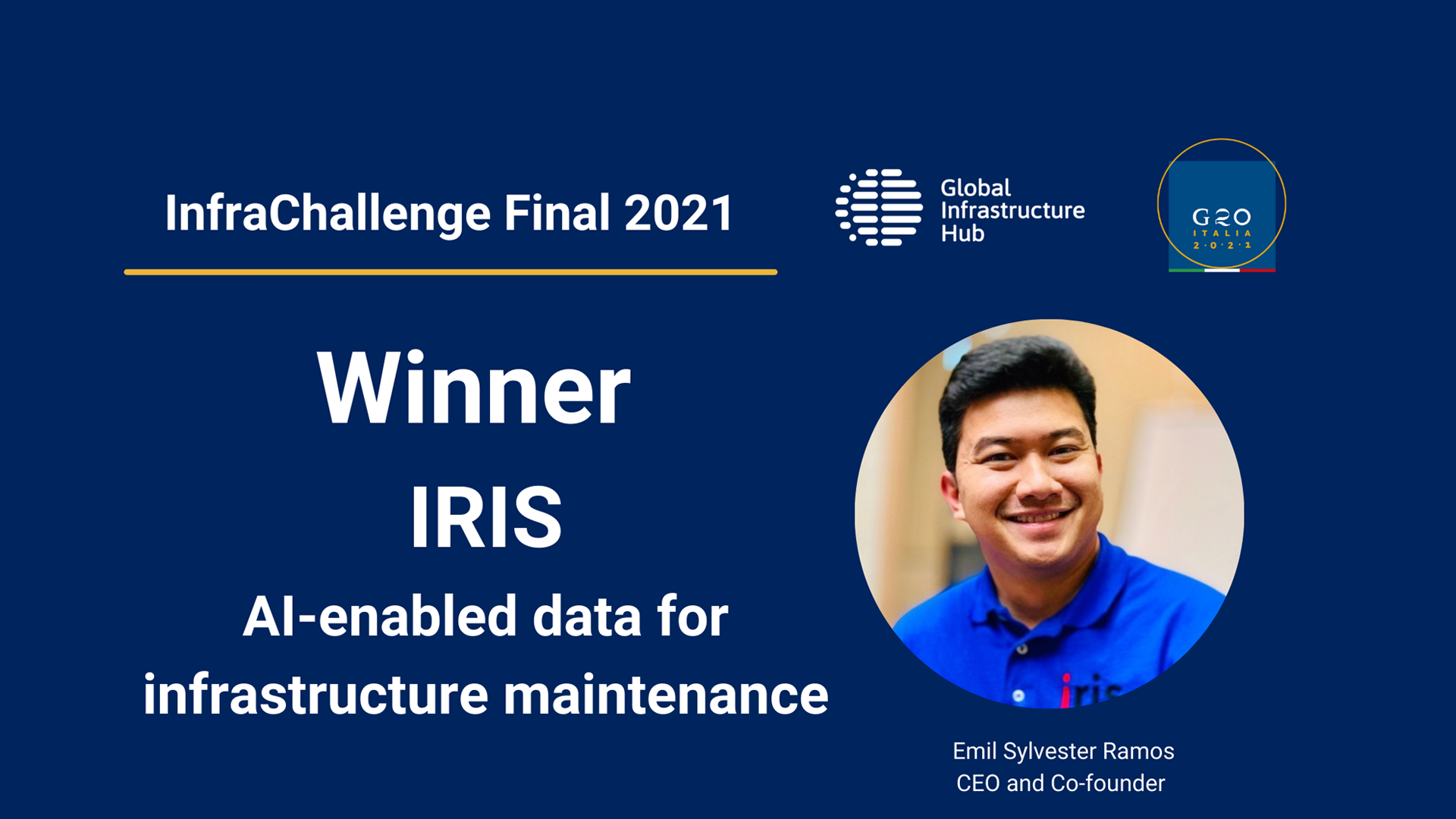

AI-enabled cameras detect road hazards in real time, enabling faster and securer maintenance for safer roads. Winning InfraChallenge will assist Canadian start-up IRIS to scale globally and reach emerging countries.

Join the GI Hub and G20 Italian Presidency for day two of the InfraChallenge final, in which the Top 10 competitors will give their final pitches of their solutions, and the 2021 winner will be announced.

New Deals: Funding solutions for the future of infrastructure

New Deals: Funding solutions for the future of infrastructure