56 results found

Over the past decade, about three-quarters of private infrastructure investment globally was debt financed, and about a quarter was equity financed.

Infrastructure equities have an attractive risk-return profile providing a competitive alternative to other investment options.

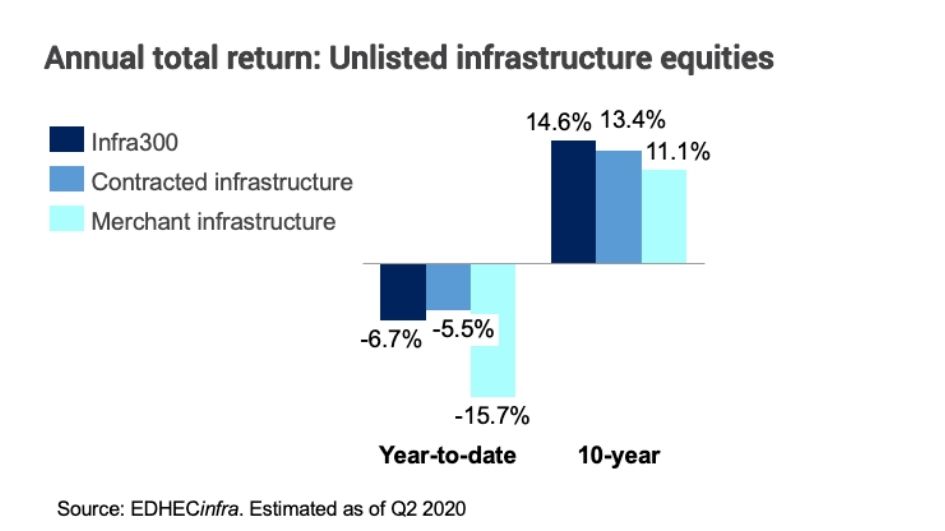

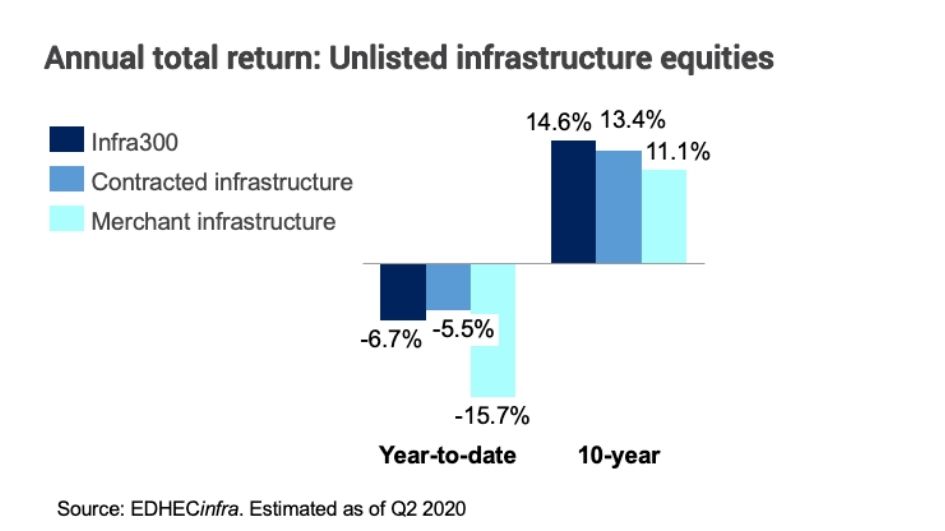

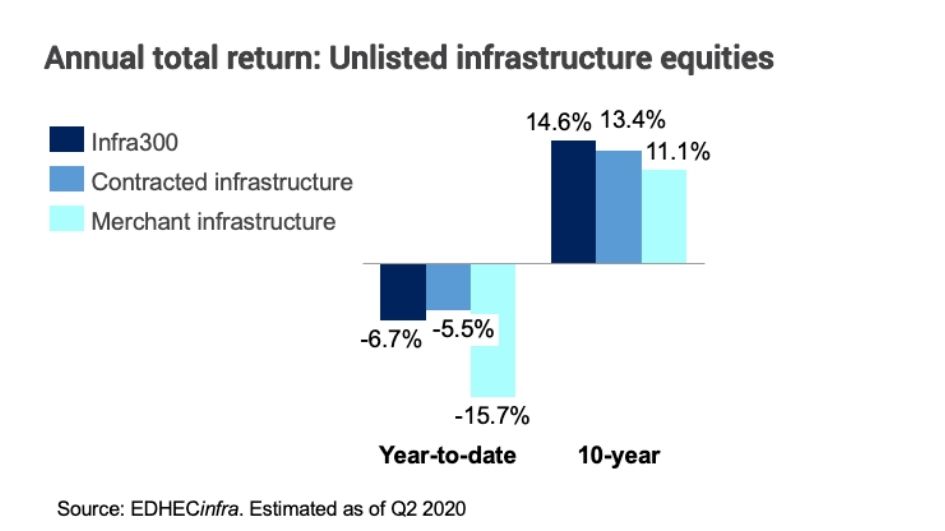

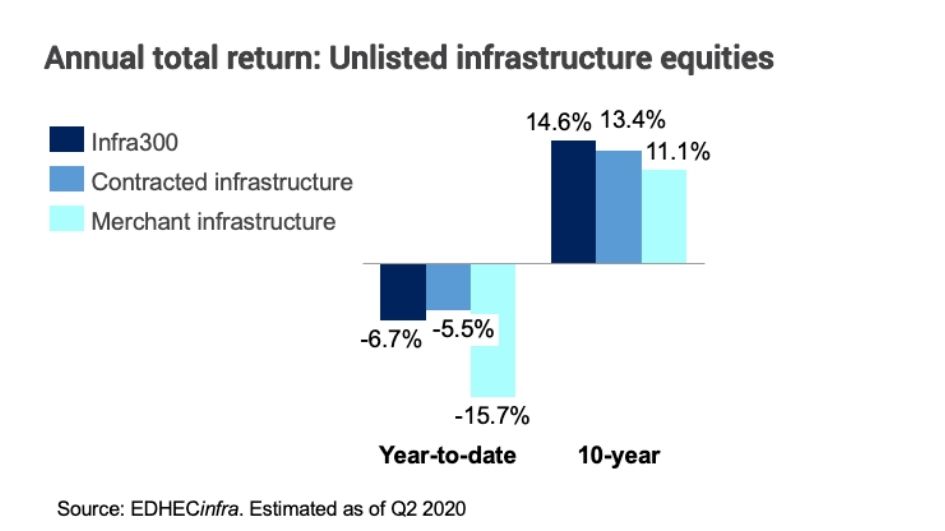

Merchant infrastructure, larger investors and the transport sector have experienced larger declines in returns due to COVID-19.

Infrastructure equities have an attractive risk-return profile providing a competitive alternative to other investment options.

Merchant infrastructure, larger investors and the transport sector have experienced larger declines in returns due to COVID-19.

Electricity investment and ICT adoption seem to be positively correlated. There is probably some degree of causation.

Countries that have lower levels of total infrastructure investment per capita are more likely to experience higher air pollution rates.

Mortality rates attributed to household and ambient air pollution are strongly negatively correlated to total infrastructure investment per capita.

Social infrastructure is the best performing segment among all country income groupings, according to new data from Moody’s that provides insights into the debt performance for infrastructure industry sector. Social infrastructure includes healthcare, education and public (community housing, prisons) facilities. The data also reveals transport and energy infrastructure perform differently in relative terms for depending on country income grouping.

The highest recoveries on infrastructure debt default occurs in Africa, the Middle East and Eastern Europe, according to new data from Moody’s shows which regions of the world have the highest and lowest default rates on infrastructure and other project finance debt investments. Ultimate recovery refers to a loan default for which recoveries have been realized following emergence from default. Emergence from default occurs when overdue interest is repaid or with liquidation or restructuring with no subsequent default or lender being taken out of the deal after repaying the defaulted loan.

Over the past decade, global private investment into infrastructure has amounted to around USD 100-150 billion annually, excluding secondary market transactions.

In 2019, renewables attracted the largest amount of private investment among infrastructure sectors, followed by transport and non-renewable power. Renewables accounted for 40% of total private infrastructure investment in 2019. Meanwhile, private investment in social infrastructure (healthcare, education and public facilities) has declined over the past decade from USD 19 billion in 2010 to USD 3 billion in 2019.