747 results found

Featured results

More results

COVID-19 is the worst crisis since the Great Depression, and it will take significant innovation on the policy front to recover from this calamity.

Discover three trends in infrastructure design and use that resulted from the pandemic and are likely going to remain relevant to the infrastructure of the future.

Find out how water scarcity is shifting infrastructure development.

Organic waste products from sources such as food production and wastewater treatment, can be converted into energy through digestion, pyrolysis, and gasification processes

Infrastructure development should demonstrate social outcomes, argues Marie Lam-Frendo, CEO of the Global Infrastructure Hub.

World Bank Benchmarking Infrastructure Development 2020

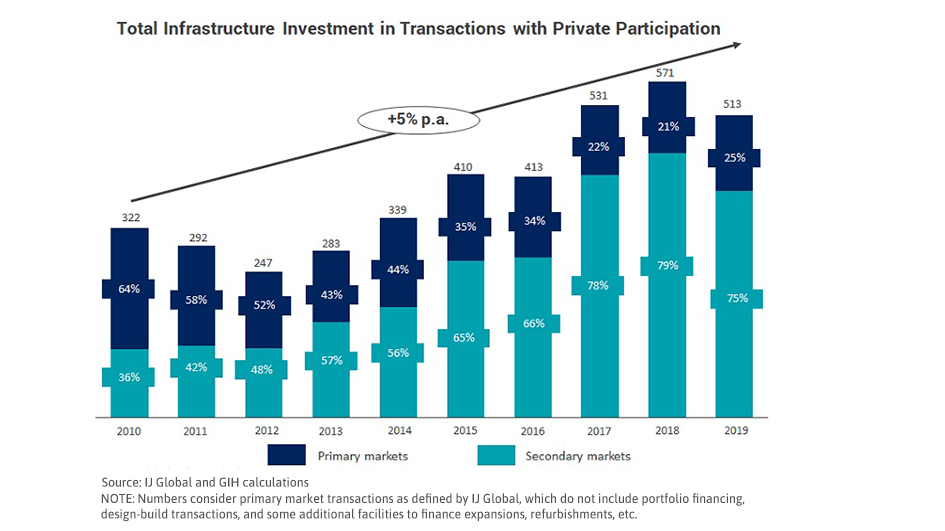

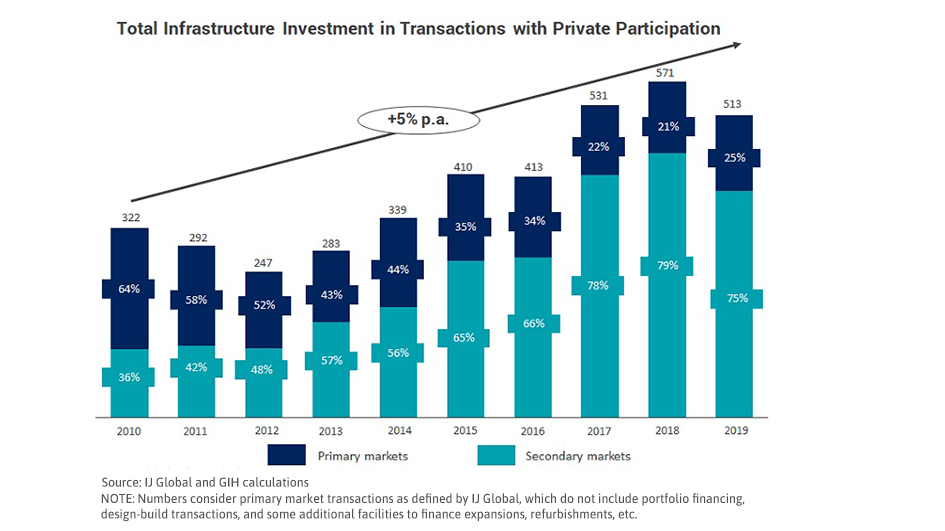

While total infrastructure investment with private participation has increased over the past decade, this has been driven by secondary market transactions. Primary market transactions are low and have been declining.

Private investment in social infrastructure has seen a sharp decline over the past decade, driven by the healthcare and social housing sub-sectors. In the transport sector, around half of private investment over the past decade has been in the roads, tunnels and bridges sub-sector.

Europe has seen the largest number of infrastructure transactions with private participation over the past decade, although the average value of these transactions tends to be relatively small compared with other regions.

The value of private investment in PPP infrastructure has gradually declined over the past decade.

Globally, foreign equity in private infrastructure deals amounted to around 12% of total private infrastructure investment over the past decade, with Sub-Saharan Africa having a particularly high reliance on foreign equity.

Sustainable low-carbon private investments have intensified in high-income countries. To strengthen global response to combat climate change, such investments must be accelerated in developing countries.

Private infrastructure investment in low-income countries is almost entirely denominated in foreign currencies, implying a structural foreign exchange risk for investors.

Over the past decade, about three-quarters of private infrastructure investment globally was debt financed, and about a quarter was equity financed.

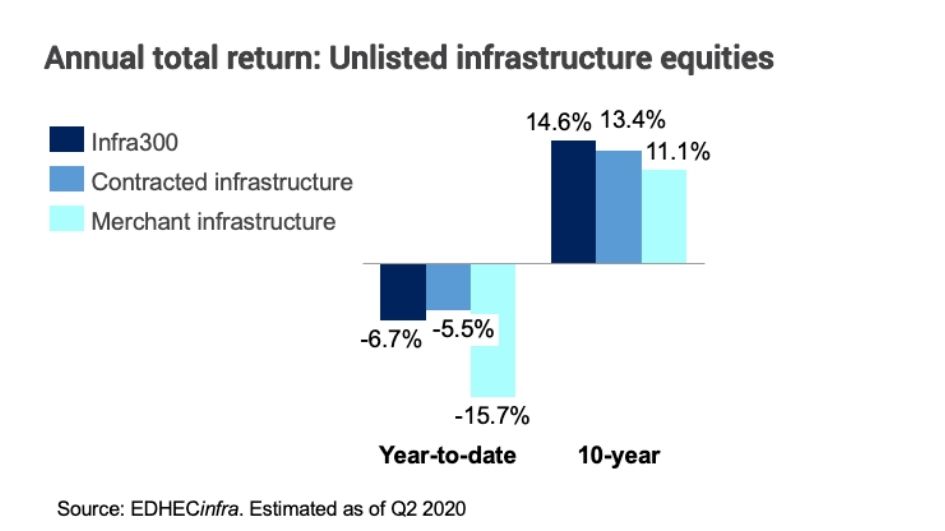

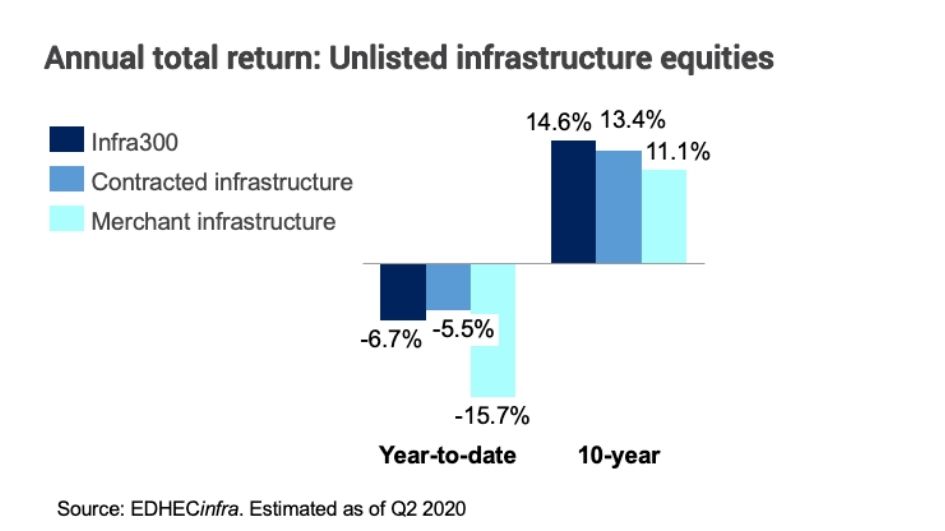

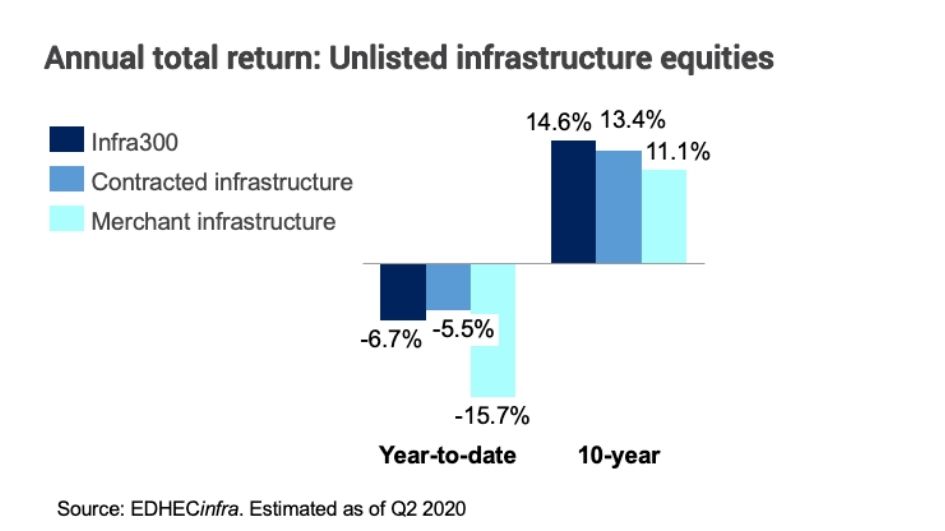

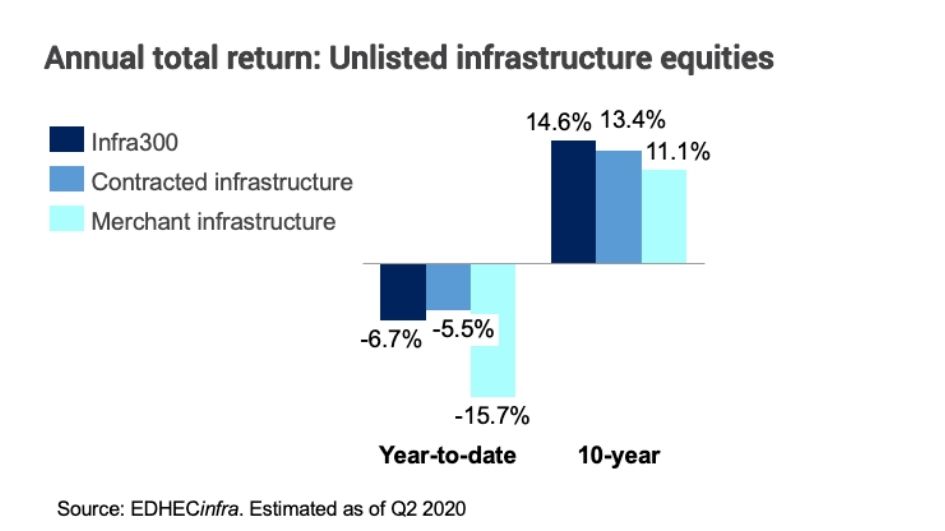

Infrastructure equities have an attractive risk-return profile providing a competitive alternative to other investment options.

Merchant infrastructure, larger investors and the transport sector have experienced larger declines in returns due to COVID-19.

Infrastructure equities have an attractive risk-return profile providing a competitive alternative to other investment options.

Merchant infrastructure, larger investors and the transport sector have experienced larger declines in returns due to COVID-19.

Good governance is key to excellence in infrastructure development. These five countries are showing the way.

Find out what implications data infrastructure will have have on business models and infrastructure delivery in the future.

Inclusive Infrastructure and Social Equity Tool

Inclusive Infrastructure and Social Equity Tool