Back

Back

Data Insights

Discover data-driven insights on selected infrastructure themes that have been developed from multiple sources to analyse infrastructure investment flows and their performance, providing momentum to strengthen data-driven discussions and decisions.

40 results found

On average, around 40% of the primary infrastructure transactions that involve private sector participation also involve a public institution. However, this varies by income group.

Public investment in infrastructure is more effective in increasing economic output than other types of public spending

Investment in public transit infrastructure can contribute to creating more inclusive societies. Public transit services are more often used by lower-income households, women and ethnic minorities.

Public investment in infrastructure is more effective in increasing economic output than other types of public spending

Investment in public transit infrastructure can contribute to creating more inclusive societies. Public transit services are more often used by lower-income households, women and ethnic minorities.

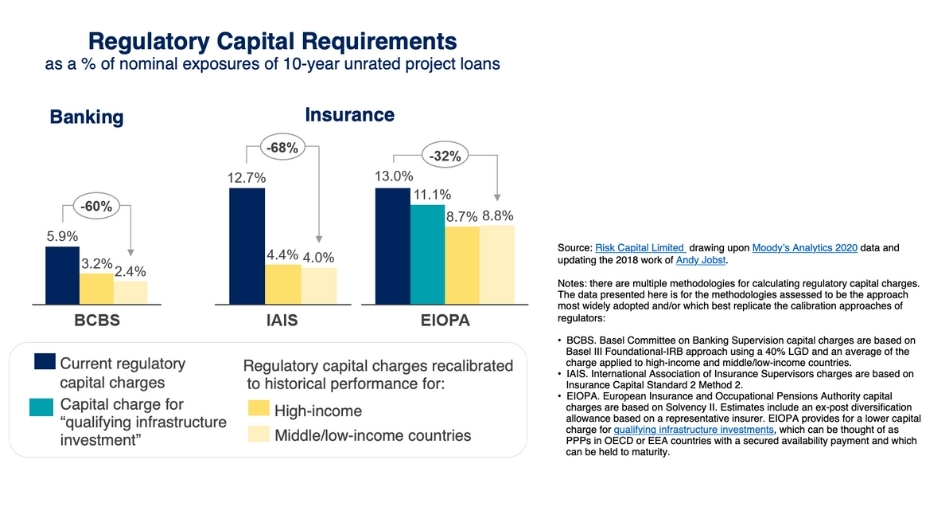

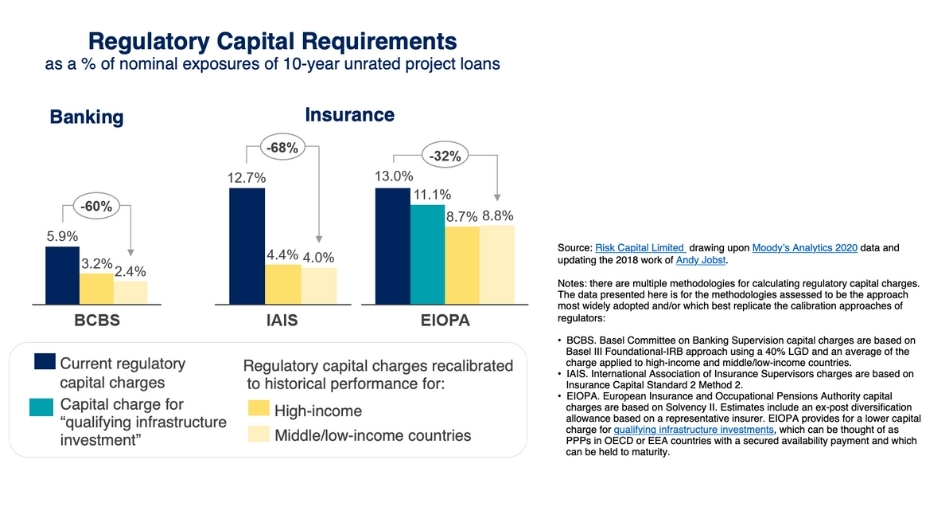

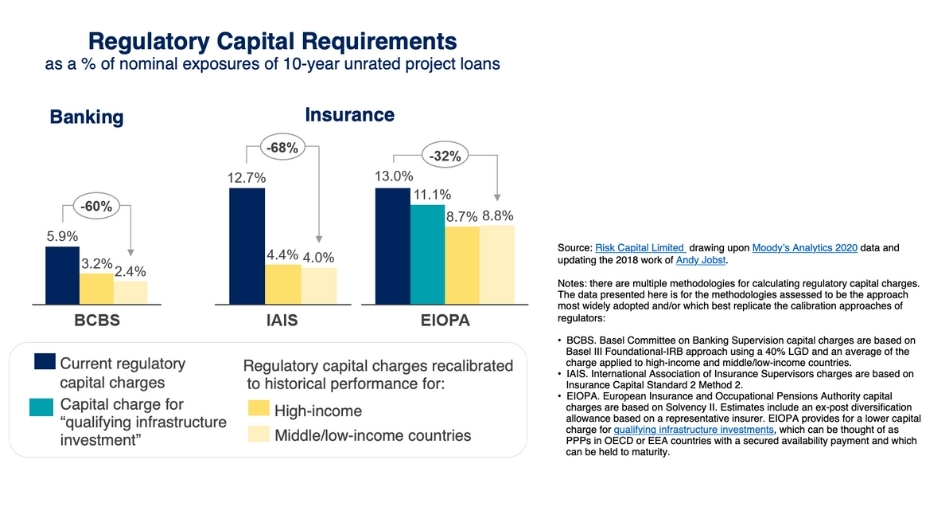

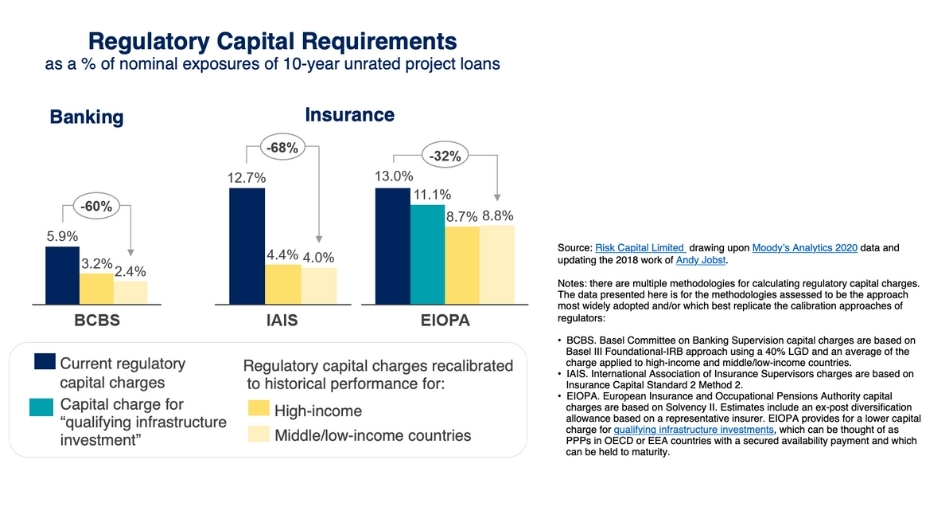

Regulatory capital frameworks require banks and insurers to put aside more capital for infrastructure investments than is warranted by their historical credit performance

Regulatory capital frameworks require banks and insurers to put aside more capital for infrastructure investments than is warranted by their historical credit performance

New insights from the GI Hub’s Infrastructure Monitor and InfraCompass show that a strong enabling environment matters for encouraging more private infrastructure investment, regardless of income level.

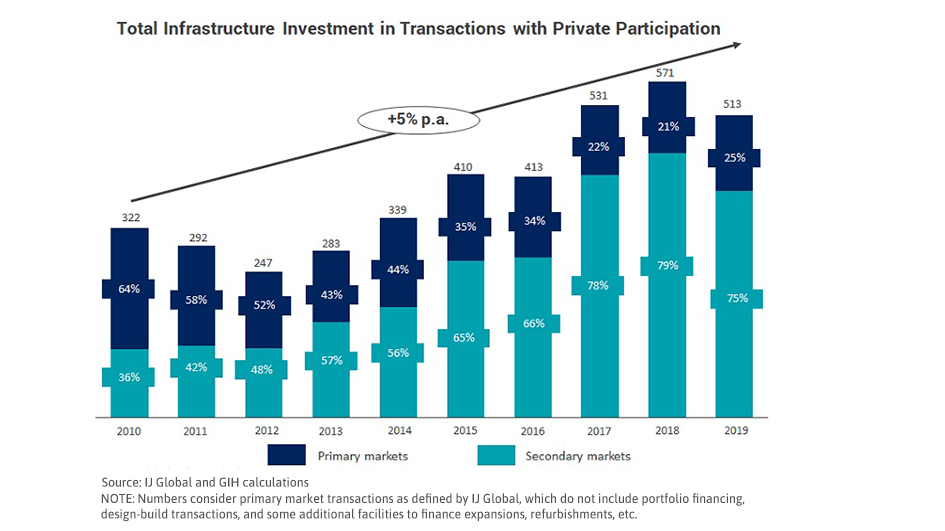

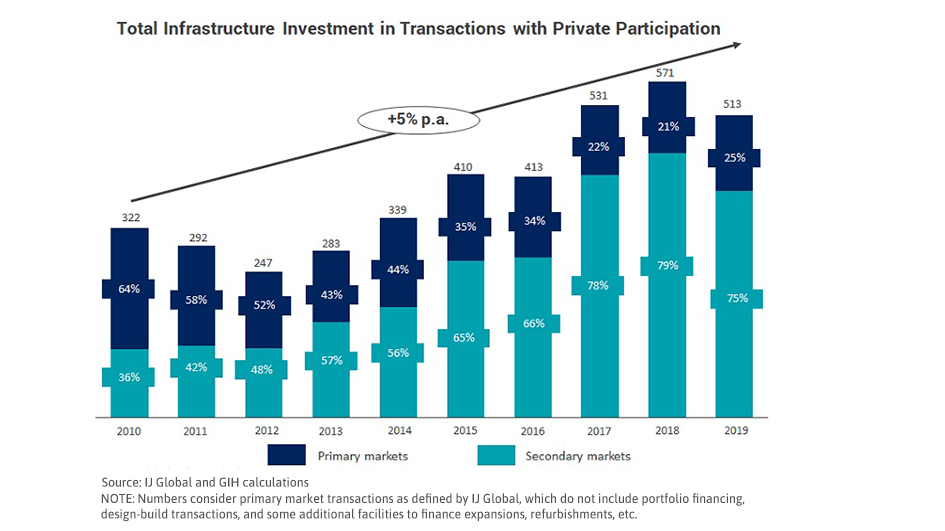

While total infrastructure investment with private participation has increased over the past decade, this has been driven by secondary market transactions. Primary market transactions are low and have been declining.

Private investment in social infrastructure has seen a sharp decline over the past decade, driven by the healthcare and social housing sub-sectors. In the transport sector, around half of private investment over the past decade has been in the roads, tunnels and bridges sub-sector.

Europe has seen the largest number of infrastructure transactions with private participation over the past decade, although the average value of these transactions tends to be relatively small compared with other regions.

The value of private investment in PPP infrastructure has gradually declined over the past decade.

Globally, foreign equity in private infrastructure deals amounted to around 12% of total private infrastructure investment over the past decade, with Sub-Saharan Africa having a particularly high reliance on foreign equity.

Sustainable low-carbon private investments have intensified in high-income countries. To strengthen global response to combat climate change, such investments must be accelerated in developing countries.

Private infrastructure investment in low-income countries is almost entirely denominated in foreign currencies, implying a structural foreign exchange risk for investors.

Over the past decade, about three-quarters of private infrastructure investment globally was debt financed, and about a quarter was equity financed.

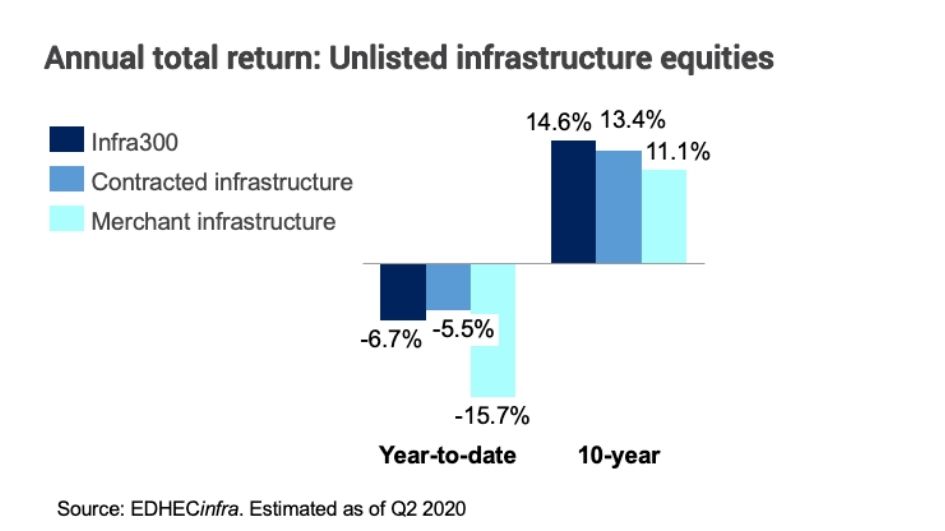

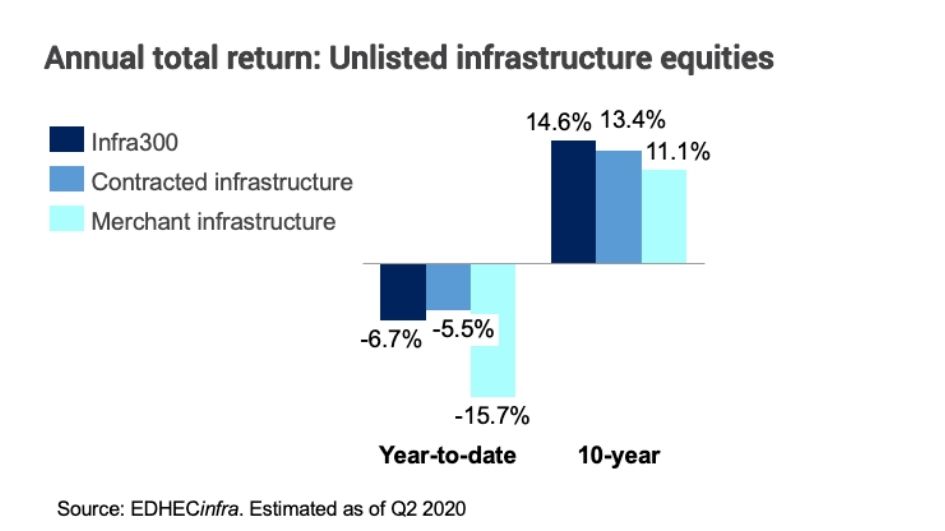

Infrastructure equities have an attractive risk-return profile providing a competitive alternative to other investment options.

Merchant infrastructure, larger investors and the transport sector have experienced larger declines in returns due to COVID-19.