Back

Back

Data Insights

Discover data-driven insights on selected infrastructure themes that have been developed from multiple sources to analyse infrastructure investment flows and their performance, providing momentum to strengthen data-driven discussions and decisions.

15 results found

Infrastructure equities have an attractive risk-return profile providing a competitive alternative to other investment options.

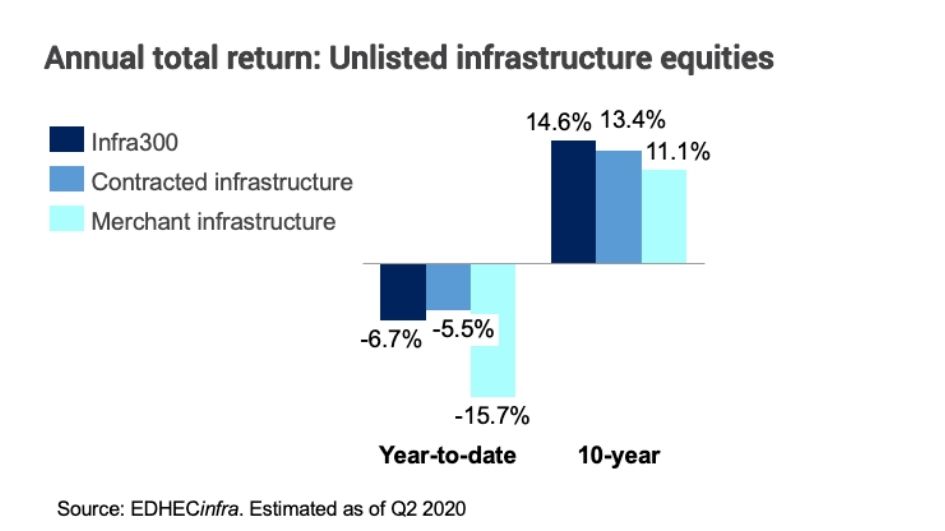

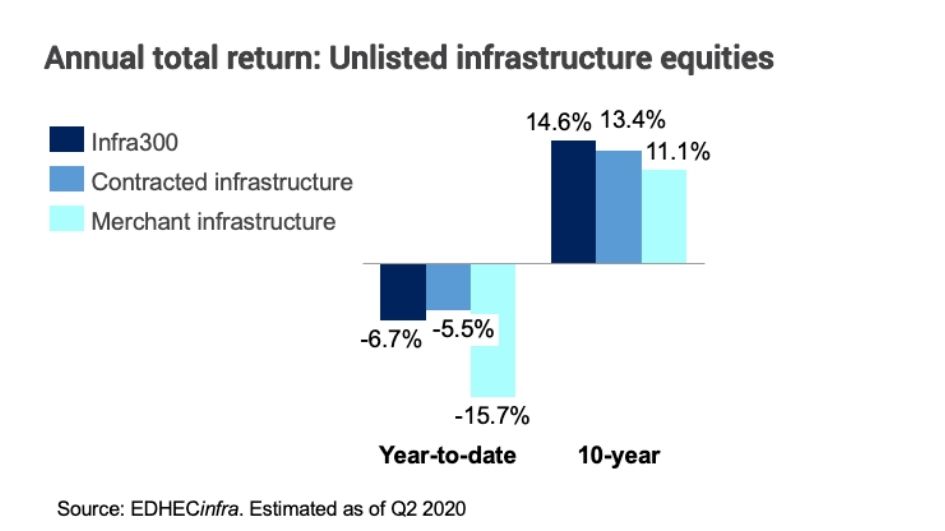

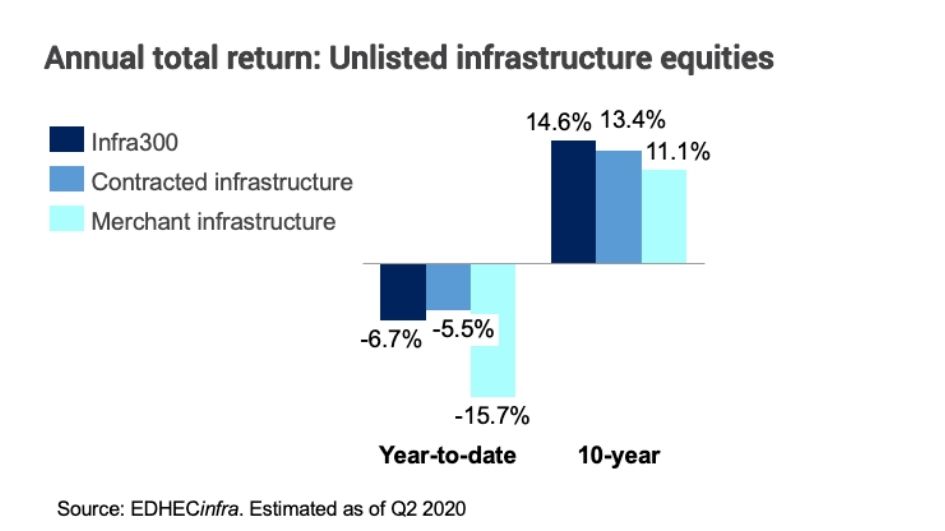

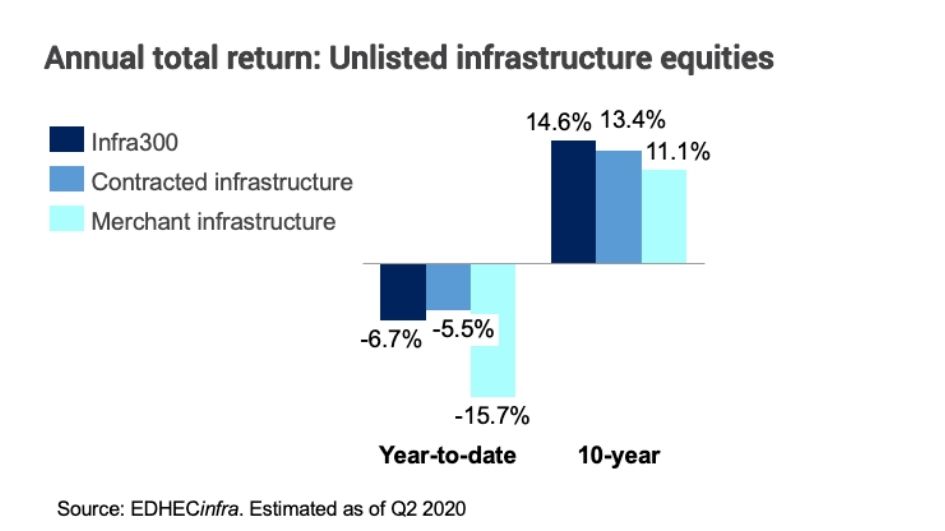

Merchant infrastructure, larger investors and the transport sector have experienced larger declines in returns due to COVID-19.

Infrastructure equities have an attractive risk-return profile providing a competitive alternative to other investment options.

Merchant infrastructure, larger investors and the transport sector have experienced larger declines in returns due to COVID-19.

Social infrastructure is the best performing segment among all country income groupings, according to new data from Moody’s that provides insights into the debt performance for infrastructure industry sector. Social infrastructure includes healthcare, education and public (community housing, prisons) facilities. The data also reveals transport and energy infrastructure perform differently in relative terms for depending on country income grouping.

The highest recoveries on infrastructure debt default occurs in Africa, the Middle East and Eastern Europe, according to new data from Moody’s shows which regions of the world have the highest and lowest default rates on infrastructure and other project finance debt investments. Ultimate recovery refers to a loan default for which recoveries have been realized following emergence from default. Emergence from default occurs when overdue interest is repaid or with liquidation or restructuring with no subsequent default or lender being taken out of the deal after repaying the defaulted loan.

The highest recoveries on infrastructure debt default occurs in Africa, the Middle East and Eastern Europe, according to new data from Moody’s shows which regions of the world have the highest and lowest default rates on infrastructure and other project finance debt investments. Ultimate recovery refers to a loan default for which recoveries have been realized following emergence from default. Emergence from default occurs when overdue interest is repaid or with liquidation or restructuring with no subsequent default or lender being taken out of the deal after repaying the defaulted loan.